Don’t write off the Spanish left

Sign up here to receive our regular Election Note!

Published 23 June 2023

Following major losses in the regional elections in late May, Spanish Prime Minister and leader of the Socialists (PSOE) Pedro Sánchez called a snap general election set for 23rd July. Polling projects the centre-right People’s Party (PP) winning the largest share of parliamentary seats, but it is currently not clear whether this will be enough for them to pass a post-election investiture vote and form a PP-led government.

Key takeaways

Conventional wisdom - supported by public polling - puts the PP ahead. Despite being caught off-guard by election timing, centre-right PP continues to hold a lead of approximately 7 percentage points

Nevertheless, it is currently unclear whether the right will be able to form a government. Three outcomes are in play and will depend on ongoing volatility, regional electoral maths, and possible polling error

Contrary to popular belief, it is too early to write off the Spanish left. Our regional election analysis shows that the left-wing coalition is more stable than pundits have suggested

State of the race

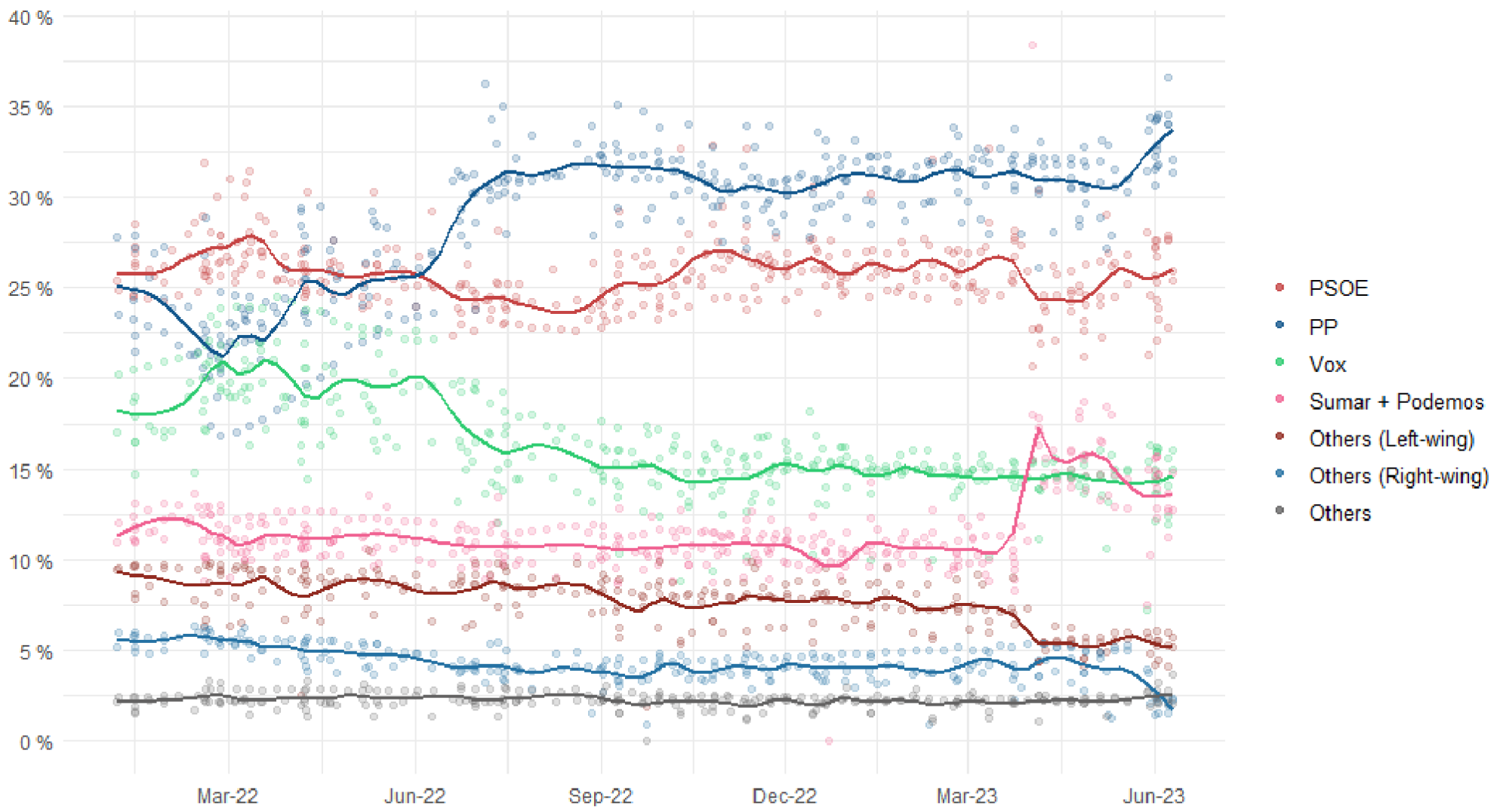

Figure 1: Trend lines of Spanish polling averages by political party

When Spanish Prime Minister Pedro Sánchez called a snap general election at the end of May, it caught opponents and allies alike by surprise. Sánchez’s Social Democrats (PSOE) have trailed behind their main opposition, the centre-right People’s Party (PP), in the polls for the last twelve months (see Figure 1).

Moreover, the dissolution of the Spanish parliament by Sánchez came hot on the heels of major losses in regional elections for PSOE and some of its allies, with the PP winning two out of twelve regions outright and in conversations with far-right party Vox to establish governing coalitions in another six. Within this, PSOE lost control of several historic strongholds such as the cities of Valencia and Seville to the right.

So why call a snap election now? At its core, this is a (somewhat strategic) gamble. General elections were due for late 2023, and by moving them up to July, Sánchez hopes to benefit from an exceptionally chaotic election run-up. First, the election caught the PP off guard and their time to prepare their campaign has now become extremely limited. Second, many Spaniards will be on holiday and unable to be at their local polling stations in July. Sánchez may hope that this applies specifically to voters with more disposable income who may be more likely to vote for the economic right. Last, Sánchez’s PSOE will hope to profit from the fact that Spaniards will now go to the polls as or immediately after the PP negotiates with far-right populist party Vox to form governing coalitions in regional parliaments (in the aftermath of the regional elections in May this year).

This has the potential to put weight behind the argument that to elect the People’s Party would be to allow Vox into national government, which may scare the more moderate PP voters. In any case, this election is a gamble, with Sánchez hoping to profit from unpredictable electoral behaviour and unify his party behind him before entrenched blame and resentment from a disappointing regional performance sets in.

Figure 2: Seat projection based on current polling averages (using uniform national swing)

With that in mind, how do the elections work? The July general election will return all 350 members of Spain’s lower house, with 176 seats needed for an overall majority. The electoral map consists of 52 constituencies, made up of 50 multi-member and 2 single-member districts. In the multi-member constituencies, legislators are elected proportionally from closed party lists. Translating vote shares to seat shares thus requires some consideration of how party vote shares are spread across the different constituencies. Figure 2 outlines projected seat shares from a simple average of vote share projections from major national pollsters since the electoral coalition between Sumar and Podemos was announced.

These projections would suggest a four-seat majority for a PP-Vox coalition. In this event, such a coalition is very likely on the back of the two parties’ burgeoning partnership agreements in regional governments despite the PP’s recent attempts to brand itself as a more moderate party. PSOE would consequently be unlikely to get a look in at government formation. Currently, PSOE, with Sumar (a united group of socialist and far-left parties) and regional left-wing allies, are projected by pollsters to win a combined total of 150 seats on average. Even if this coalition were to leverage the support of independents and regional parties, this would still leave them ten seats short of a majority.

Why does this election matter?

With just over a month until the election, this projected majority is too slim for the People’s Party or Vox to take their foot off the pedal. A handful of changes in local circumstances or the public profile of individuals on party lists could be enough to keep the two parties from winning a majority. Any modest rise in electoral support for Sumar, following the healing of political and policy divisions, between Podemos and the Sumar coalition would have the same effect. A PP-Vox coalition seeking to build an outright majority would also struggle to rely on the support of independents and regional parties, given Vox’s stringent opposition to devolution.

With that in mind, there are three possible outcomes of this election. According to most pollsters these are, in descending order of likelihood: a right-wing coalition government, a left-wing coalition government, and a stalemate followed by a second general election. Given current polling, that first option remains the base case of most analysts, but given the chaos of a short campaign and the difficulties around converting votes to seats in Spanish electoral maths, polling numbers are likely to be volatile.

A brief summary of the consequences of each electoral outcome is listed below:

1. A right-wing coalition government, with the People’s Party as the major partner and Vox as the minor partner. According to most polling, this is the most probable outcome. This would likely result in a moderate conservative swing in policy as the PP are campaigning on a manifesto of tax cuts and a vaguer, more expedient aim of repealing ‘Sanchismo’. Given the need for Spain to continue down the path of fiscal consolidation, adjustments to both tax and spending are likely to be minor. However, we note that negotiations with Vox may result in more conservative fiscal concessions as a condition of coalition formation, as well as a deterioration of relations between Madrid and many regions seeking greater devolution when the coalition takes office.

A right-wing coalition government would also take office at a late stage in negotiations with the European Commission on the rollout and use of the EU Recovery Fund, meaning that adjustments to the direction and purpose of this financing are also likely to be minor. Similarly, Spain is due to hold the presidency of the EU Council in the second half of 2023, meaning that the new government would have little time to form a significant new agenda. Instead, it would likely focus on core issues for the Spanish right (immigration and protection for farmers) whilst pursuing a more de-politicised presidency focused on technocratic Council goals.

2. A left-wing (minority) coalition government, consisting of PSOE and Sumar in a confidence and supply agreement with several left-wing regional parties. This would occur in the event that left-wing and regional parties cling on, securing enough seats to deny a right-wing coalition a working majority.

In the event of a left-wing coalition, Spain would see broad continuity of government, particularly with regards to cost of living and energy support for households and fiscal policy. A PSOE-led administration would further its aims in negotiations with the EU Commission over the use of Recovery Fund financing, with this government already in the process of adjusting several objectives following changes in the energy market and delays to previous rollouts. Continuity of government would also mean the furthering of left-wing objectives via Spain’s EU Council presidency. In particular, PSOE is keen to progress reforms to the EU’s fiscal rules.

3. A second general election, if neither PSOE nor PP are able to gather together coalition or supply partner parties enough for parliament to pass an investiture vote in the new government. Although it is slightly less likely than the other outcomes, this is by no means impossible. However, almost all political actors will be looking to avoid a second election given the recent negative experience of two general elections in 2019 due to the failure of government formation. A protracted period of government formation requiring fresh elections would also squander Spain’s presidency of the EU Council as an opportunity for policy change and interstate relations within the organisation.

Why a surprisingly resilient Spanish left could still prevent a right-wing majority

Thus far, many commentators have spelled out a narrow victory for the right in July as the most likely outcome following a drubbing for the left in the May regional elections. Some have gone further, arguing that the poor performance in regionals and PSOE lagging in national polls are bellwethers for longer-term declines in the composition of the Spanish left as the People’s Party appears to have captured significant centrist support. Polls suggest around a quarter of Spaniards voted in the regionals on the basis of national issues, and that Sánchez has become an unpopular premier.

However, we argue that the Spanish left retains more of a fighting chance at forming a government than many expect. Looking at the regional elections more closely, there is limited evidence for the “decline-of-the-Left” narrative. Figure 3 charts overall swing for each party in the regional elections, and demonstrates that despite lagging in the polls, PSOE in fact increased their overall vote share relative to the last major set of regional elections in the same regions in 2019. Moreover, the sizable swing towards the People’s Party is not driven by an exodus of alienated PSOE voters. Instead, it stems from voters migrating from the centre-right Ciudadanos (Citizens), which had grown rapidly following the Great Recession but collapsed in vote and seat shares in the regional elections.

Figure 3: Swing per party in May 2023 regional elections

Whilst smaller and more radical left-wing parties did lose vote share relative to 2019, some of this will also have been migration to the centre-left PSOE rather than the radical or centre-right. Therefore, in the aggregate at least, it seems that the brunt of the apparent decisive swing towards the right in these elections is driven by the exiting of a key right-wing party from the electoral arena - and the subsequent migration and consolidation of right-wing votes - rather than the centre-left bleeding votes to the centre-right, per se.

With regards to seat share in the regionals, much of the victory of right-wing parties in the recent elections was due to the relative failure of far-left parties to form electoral coalitions rather than any significant changes in electoral preferences or the left’s core support. Collectively, far-left parties such as Podemos and the United Left won around a fifth of the overall vote share, marking continuity with previous regional and national elections. However, many regional parliaments now lack socialist representation proportional to this vote share due to split-ticketing between competing left parties. The eleventh hour electoral coalition struck between Podemos and Sumar for the July general election could prevent a repeat of this.

So what do the Spanish regional election results really tell us about what can happen on July 23rd? We used the May regional election results, specifically its region-level swings, to predict the results of the next Spanish election at the constituency level. By applying recent region-specific swings to national vote shares, we can get a sense of what would happen if the July national elections show the same type of voter shifting as the May regional elections did. Naturally, this is not a perfect election prediction, but it can be a useful tool to help us get an early view of Spanish electoral geography.

The effects of this exercise are clear; the use of uniform national swing by most pollsters to project seat shares for the upcoming election notably underplays the PSOE vote. Based on uniform national swing and current polling averages, PSOE is estimated to win 98 seats. Accounting for swings in last month’s elections bumps up PSOE’s seat share to 106 seats and reduces the PP-Vox coalition’s vote share to a knife-edge of two seats. Given the unpredictability in this election, borne of its unusual timing and a new electoral coalition on the left, this margin will be too close for comfort for the People’s Party and Vox. Without an absolute majority, a right-wing coalition would have to draw support from right-leaning regional parties - a tough ask given Vox’s firmly anti-devolutionary stances.

Figure 4: PSOE overperformance (%) using regional-level swing compared to uniform national swing

A fuller comparison of region-level swings with the uniform national swings assumed by pollsters finds large gaps in their predictions for PSOE vote share. Figure 4 maps the gap between the average pollster’s projected swing for PSOE in June (-2.44%) with actual swings from May’s regional elections. Contrary to the ‘decline-of-the-left’ narrative, PSOE performed well in some of its historic, industrial strongholds such as Valencia in the regional elections, subsequently losing control of the region only due to the consolidation of right-wing vote in the People’s Party and divisions on the far-left.. Here, our regional swing adjusted model gives PSOE a vote share that is almost 7pp higher than under uniform national swing. The party’s poorer performances were in Extremadura and Murcia, where Vox achieved moderate success in 2019. This illustrates how centre-left vote share is more resilient in some regions than in others, and holds up surprisingly well in some of PSOE’s core constituencies. Should the July national elections show the same trends as the May regional elections, PSOE losses could be significantly smaller than expected.